goldierocks said:

Crevice Sucker, can you fill me in on this auction?

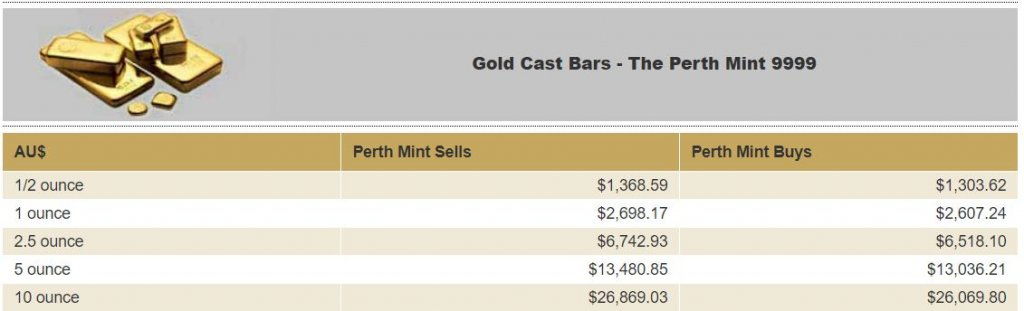

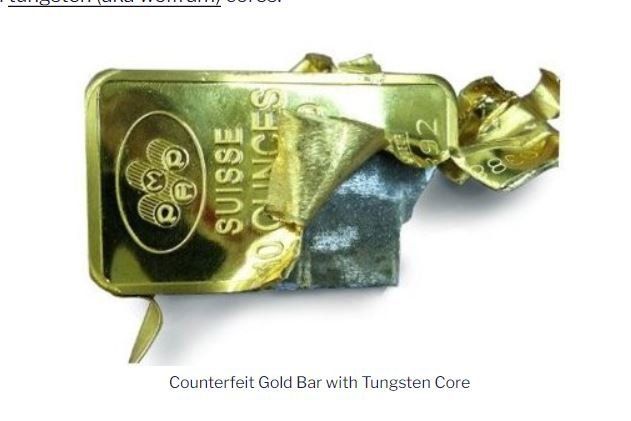

Firstly, why does one buy at auction something that can be bought daily at the going gold price? And why would anyone sell at a lower price?

Secondly, why are bids so low - isn't that just the seller putting a price on each item to get the bidding started? For example, why would a 10 oz ingot only have a ridiculously low bid of $2,202? Or a 400 oz bar only $23,500? If things were really going to sell at prices anything like that, there would be huge interest on every one of them (the seller could easily sell them anywhere for many times the price without bothering with the auction. But obviously that will not happen - I can't believe that even one of these prices was put on by a real bidder? I don't understand the reason, whether it is simply to get bidding started or just to bring people to the website that sells other things as well.

Australian dollar spot price for gold today is $2,662. So the price of 400 oz is $A1,064,800

As for interest in gold, for decades now the world mine production of gold has been around 25% lower ounces than the world demand. There is ALWAYS interest in gold.

So can you explain - what am I missing here?

The seller is unlikely to be putting bids on , When i saw this auction start I was one of the first to bid , the prices started from zero , I have put bids on more than half of whats in the sale and watched while other buyers with different buyer numbers came in randomly to outbid me on the way up.

It is possible that I will be outbid past my limit but I am hoping there are things I win because they are overlooked in the melee.

I have no doubt some items will sell well above their bullion value and some might sell for less. Natural nuggets and crystalline gold easily sells for higher than bullion content because of their natural visual merits.

When I saw the 400 ounce bullion bars I was surprised to see them listed because I wouldnt have expected them to attract the right level of interest in Australia , if it was me I would have listed them at Sothebys in Dubai , New York or London to appeal to that level of buyer.

You ask why are prices so low the answer is they start from zero and buyers all have different tactics , some will wait until the last half hour before they start bidding and other buyers dont have time to sit there so they throw on their maximum bid early in proceedings and go back to doing other things. You can put an auto bid of $500 on an item but if there are no other bidders you might take it home for $10 for all you know.

If there are items that dont meet the sellers expectations the auctioneer might advise the buyer that it didnt meet reserve.

I have bought and sold mining equipment with these guys and other auction institutions around the country for many years and I trust Lloyds , there are 2 other auction businesses I would never trust to sell even a mouldy scone because I have sprung them doing dodgy things in the past but cant name them publicly for obvious reasons.

Some other auction sites display the initials and location of the bidders chasing each item which is great for transparency , I wish they all did that.

If you worry that auction staff would bid you up higher I dont believe so as they are all understaffed , if you try to ring them for information about sales you would be lucky to get a call back within a few days ,and some of the other auctions wont bother ringing at all because they are paid at the lower end of the scale and treated likewise , they dont give rats about their job , at least Lloyds do have a good history with actually replying to emails and phone calls.