silver

silver

- Joined

- Dec 19, 2013

- Messages

- 18,889

- Reaction score

- 25,813

Here's reality (pretence)

In 1966 you could buy 6 raspberry lollies for1c

30 for 5c

300 for 50c

3,000 for $5.00.

60,000 for $100.

In 1966 I put aside $100 as 5$20 notes.

As well as $100 as 20050c rounds.

Today at the supermarket I used the 5$20 notes from 1966 to pay just under half of the $215 grocery bill.

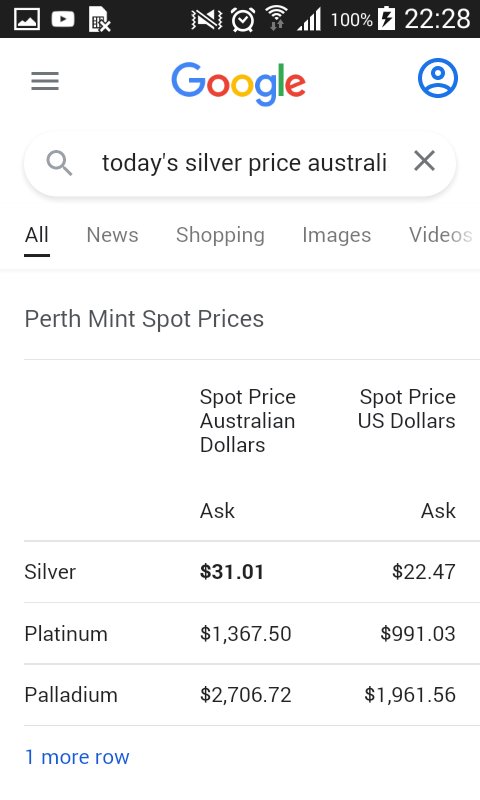

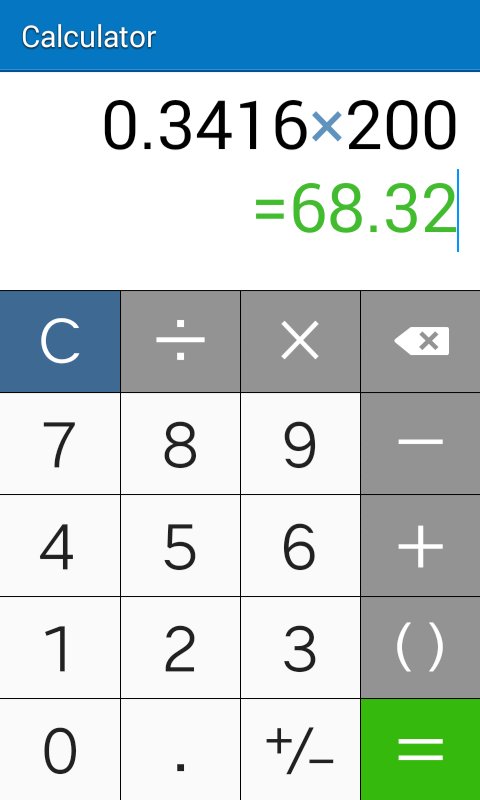

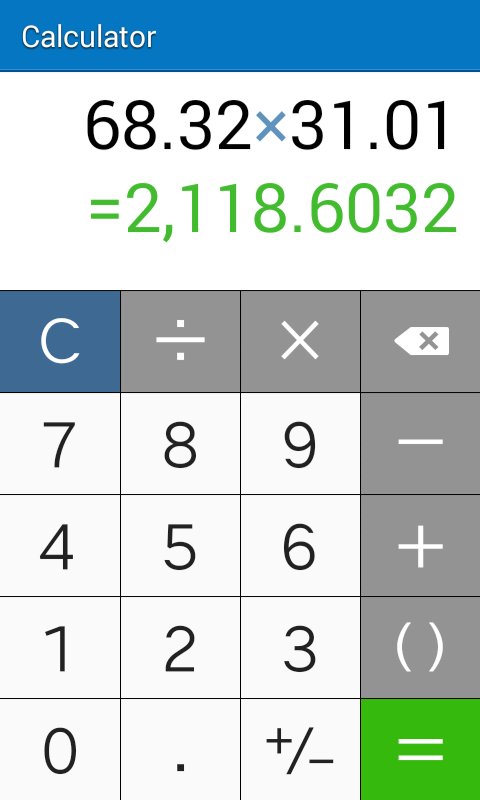

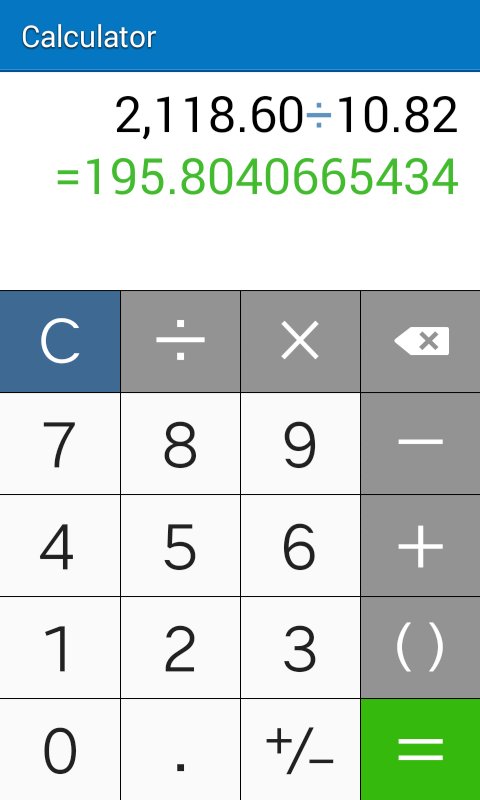

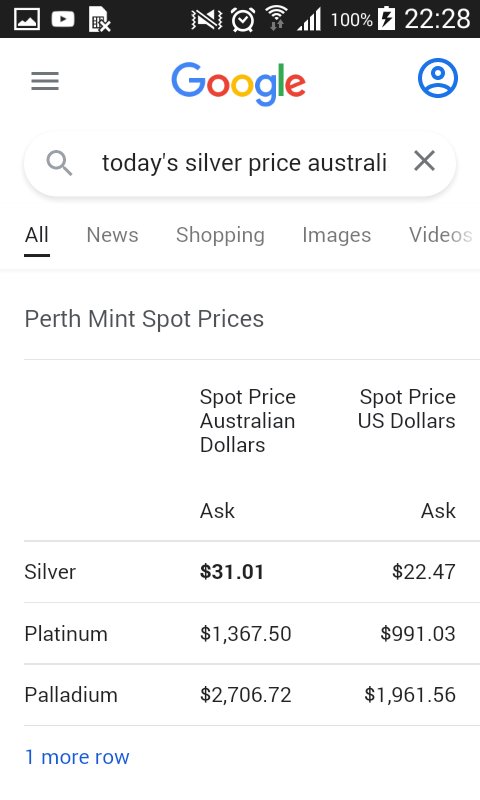

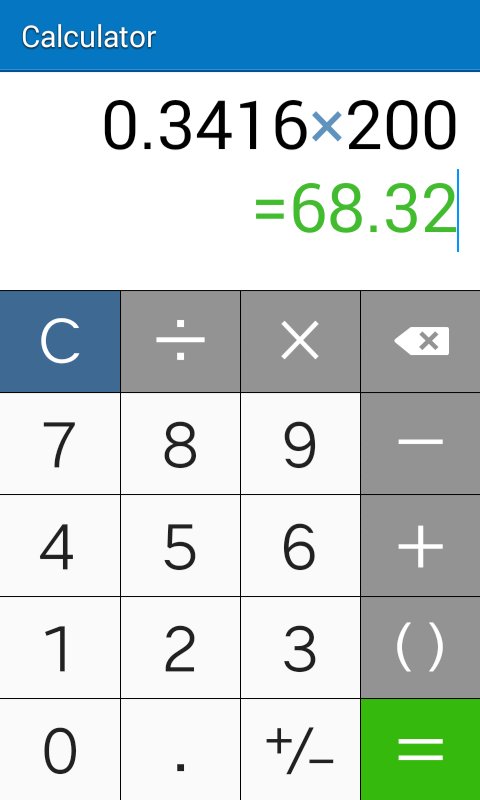

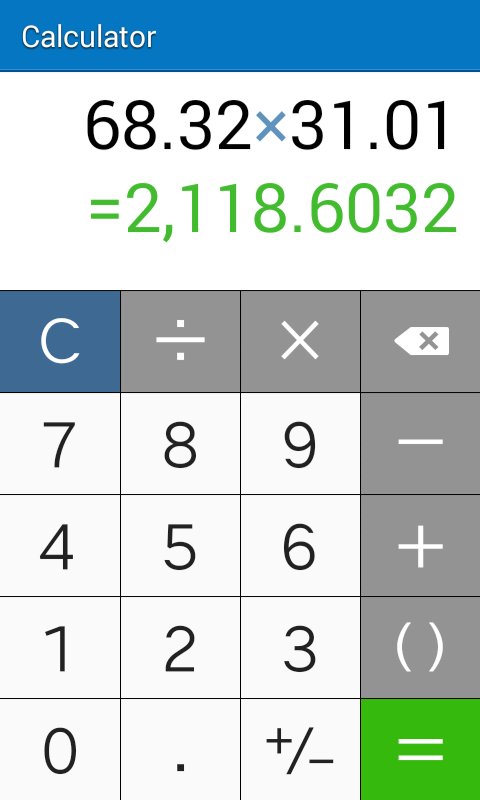

Today the equivalent $100 as 20050c rounds weighing a total of 68.32 Troy ounces silver and with silver being worth $31.01 Australian dollars per ounce is worth a total of$2118.60

So with that I could still buy an awful lot of rasberry lollies now I recon

Edit....

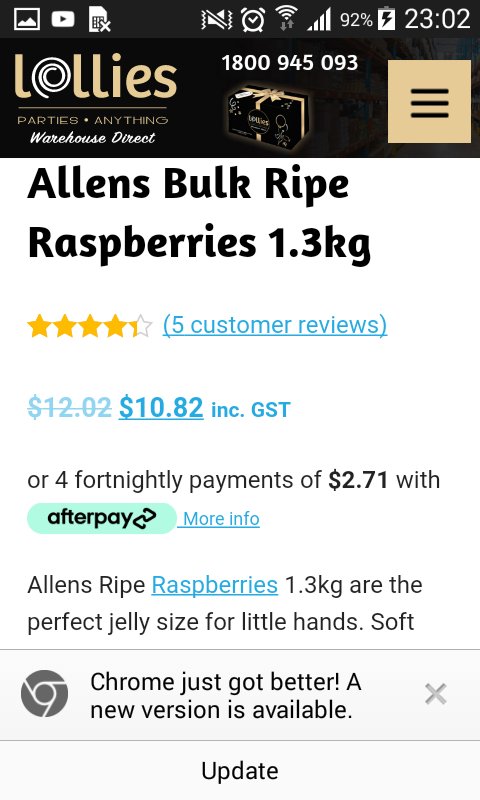

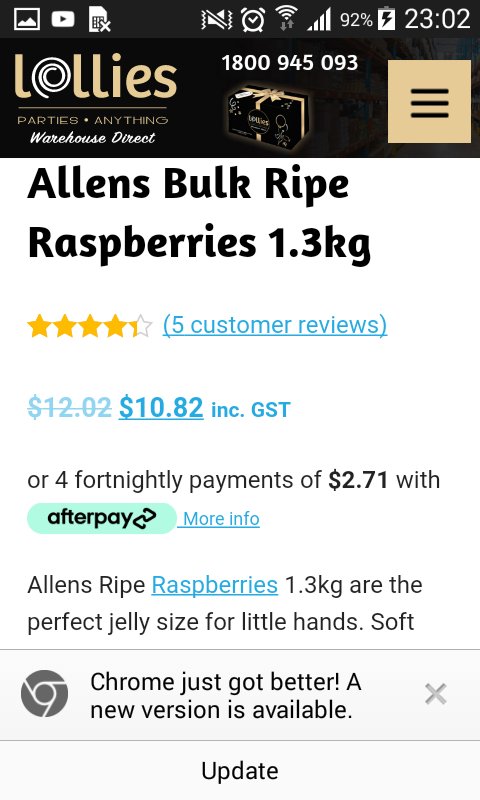

Ok so online rasberry lollies

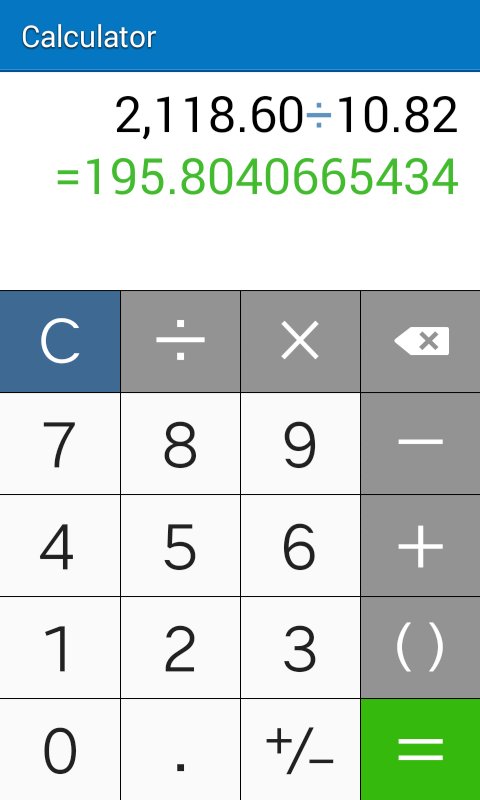

Total silver worth devided by product price

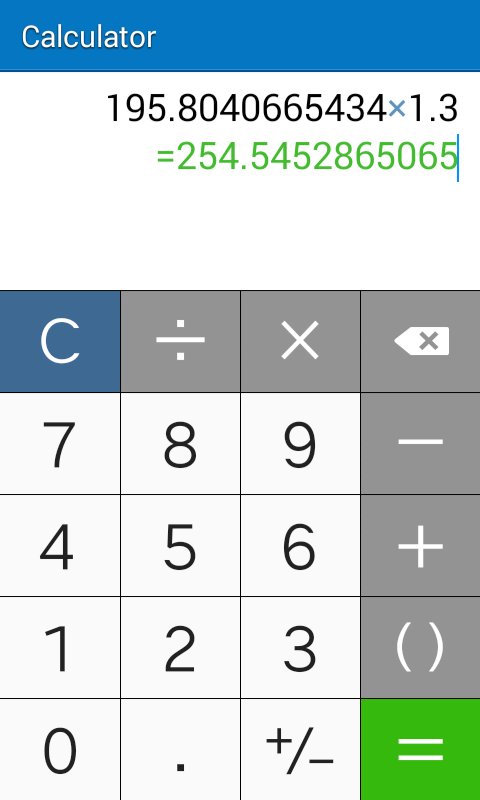

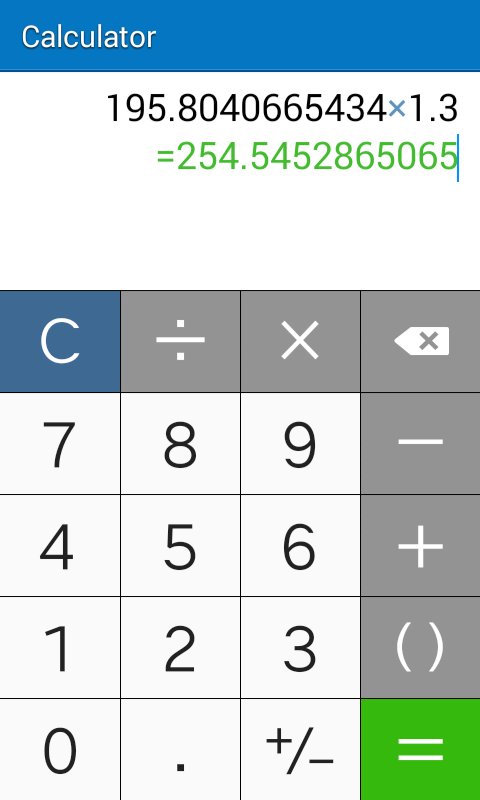

And multiplied by the 1.3Kg product size

So 255.54 Kg (just over one quarter of a tonne) is a sight more than the $100 paper monies worth I could of bought.

lets you see that precious metal holds over real time whilst inflation eats normal cash over time without you really being able to see it in action.

only through actively engaged hindsight can we gain perception in a way that is plainly quantifiable.

In 1966 you could buy 6 raspberry lollies for1c

30 for 5c

300 for 50c

3,000 for $5.00.

60,000 for $100.

In 1966 I put aside $100 as 5$20 notes.

As well as $100 as 20050c rounds.

Today at the supermarket I used the 5$20 notes from 1966 to pay just under half of the $215 grocery bill.

Today the equivalent $100 as 20050c rounds weighing a total of 68.32 Troy ounces silver and with silver being worth $31.01 Australian dollars per ounce is worth a total of$2118.60

So with that I could still buy an awful lot of rasberry lollies now I recon

Edit....

Ok so online rasberry lollies

Total silver worth devided by product price

And multiplied by the 1.3Kg product size

So 255.54 Kg (just over one quarter of a tonne) is a sight more than the $100 paper monies worth I could of bought.

lets you see that precious metal holds over real time whilst inflation eats normal cash over time without you really being able to see it in action.

only through actively engaged hindsight can we gain perception in a way that is plainly quantifiable.